- About us»

- Net income calculator»

- Population aging»

-

- Least developed regions»

-

- Average wage

- Material need benefits

- Meal allowance

- Counties of Slovakia

- Inflation

- Living and Subsistence Minimum

- Unemployment of Czechia and Slovakia

- NACE Classification

-

- Life expectancy

- Gender differences

- Youth unemployment and NEET

- Minimum wage in EU

- Unemployment rates of different age groups

- Share of salaries on GDP

- Percentage of employees ususally working at nights

- Unemployment rate

- NEET

- Long term unemployment

- Employment rate

-

- Bratislava and surroundings

- Kopanice

- Danube river

- lower Vah river

- middle Vár river

- upper Nitra river

- lower Nitra river

- Mining cities

- Kysuce a Orava

- upper Vah river - Liptov

- Spiš cities

- upper Hron river

- Juhoslovenská kotlina

- Košice fold and Torysa river

- upper Zemplín

- lower Zemplín

- EU regions

- NUTS3 regions of Slovakia

- LAU1 dataset

-

- Projects and activities

- Inclusive growth»

- Good work

- Project SKRS

- Social system – reality and vision

-

- Education of unemployed

- Young unemployed not taking part in education

- Proposal to change the system of education funding

- Library

- News»

- Contact

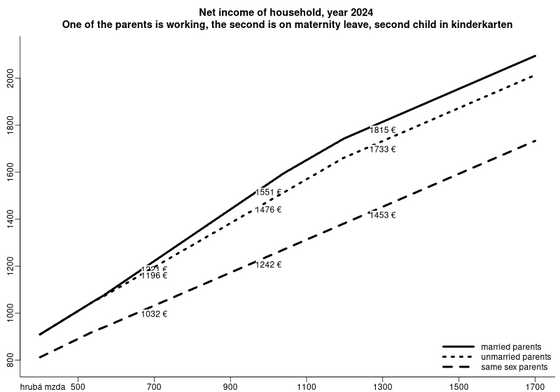

Marriage

The tax system in Slovakia je based on formal status of partners cohabitation. Non-taxable income is possible only on husband/wife and child tax benefit is available only to parents written in the birth certificate. If these conditions are not met, it changes income of the household.

In the graph, we calculate net income of a household with one of the parents being on maternity leave with a child under three years of age and a second child in kindergarten. The other parent is employed with salary displayed on the X axis. We compare three types of households:

- the first is a married couple,

- the second is not married couple (so no tax benefit for wife on maternity leave),

- the third is not married couple and the working parent is not written on the birth certificate (eg. same sex couples or one of the parents in divorce).

The difference is significant and can be up to tens of percent of income.

Suggested citation: PÁLENÍK, M.: Dávkový, daňový a odvodový systém na Slovensku, Inštitút zamestnanosti, Univerzita Komenského v Bratislave, 2023, ISBN: 978-80-223-5755-5, doi:10.5281/zenodo.10403110.

Book on net income calculator

Book on net income calculator describing various aspects of tax, contributions and benefits system in Slovakia.. . .

Share

Share Facebook

Facebook Twitter

Twitter News

News